Does Using a Safe Withdrawal Rate Mean I Likely Die With No Money?

No, in fact, you are likely to leave behind substantial assets. Plan for it.

It is common misconception that if you use a Safe Withdrawal Rate (SWR) approach to generating income from your investments, that you will die with zero money. But that is not the case.

(If you’ve not read our initial posts on Sequence of Returns Risk and Safe Withdrawal Rate, you might want to read those before continuing.)

The Word “Safe” in SWR is the Key

The work on SWR generally suggests an SWR that did not fail in historical backtests and/or a large number of simulations of various rates of return and variation on that return.

As we show below, what happens when you pass with more than $0 is often a very large balance.

Balance at Death Based on Simulations

Simulations are a convenient way to analyze problems like this, and allow us to run a wide range of parameters like investment return and variation and generate a large number of outcomes.

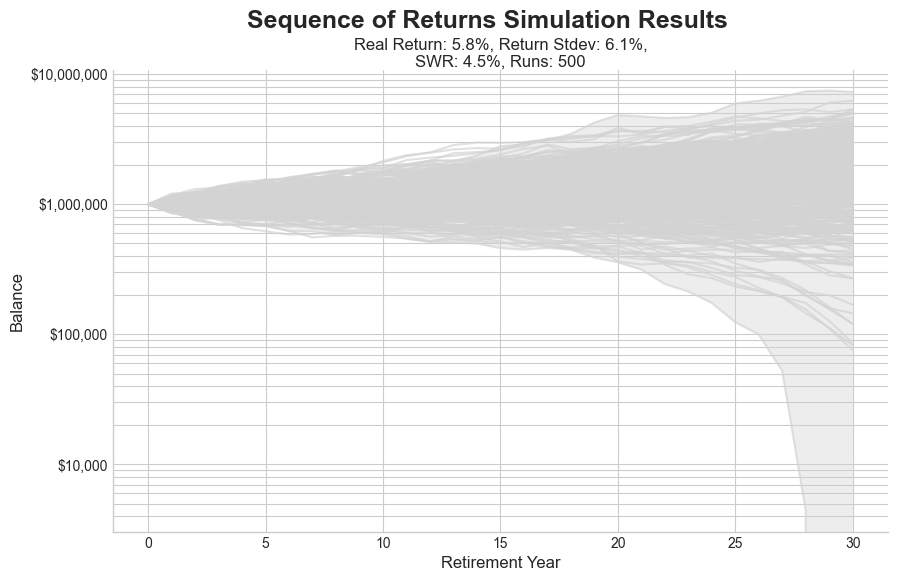

The chart above is a simulation of the balance of a retirement account, that starts with $1M, over a 30 year retirement. There are 500 runs of the simulation, and thus 500 simulated balances, for a SWR of 4.5% assuming average returns of 5.8% at a 6.1% stdev. (This is the approximate return and stdev for a portfolio of 40% stock, 60% high yield bonds.)

In these simulated results, there was a single failure where the account balance reaches 0 before the 30 year retirement; that was at about 28 years. But there are times the balance is ~ $7M.

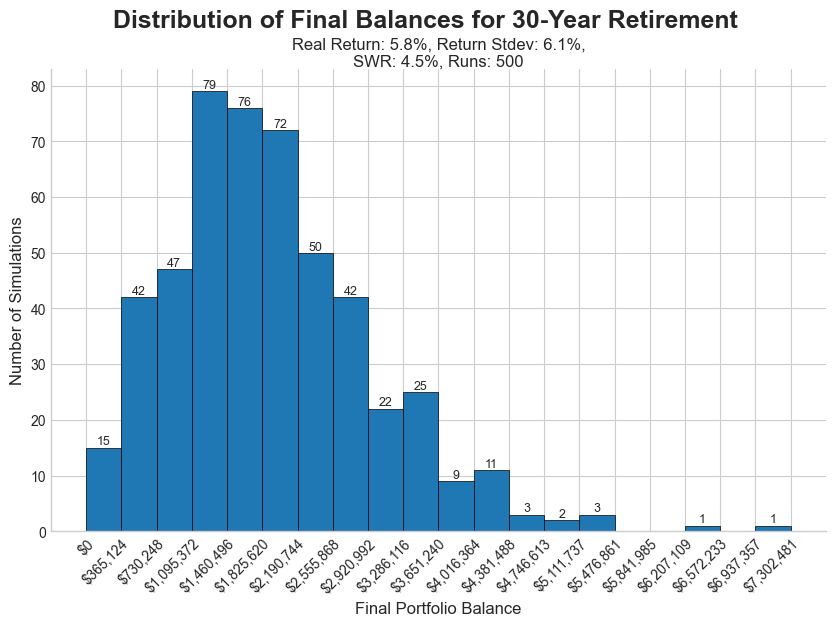

Let’s look at histogram of the the final balances for the above data as that is easier to understand the distribution of final account balances.

There is a %20.8 chance ((15+42+47)/500) you pass with < $1M; which means there is an 79.2% chance you pass with > $1M (or $1.095M to be precise). Further, there is a 15.4% chance you pass with > $2.9M remaining in your account.

Balance At Death Based on Historical Data

The downside to a simulation is that it isn’t real data. The downside to historical data is that there isn’t that much history, and even then you have to question if what happened in financial markets 100 years ago still applies.

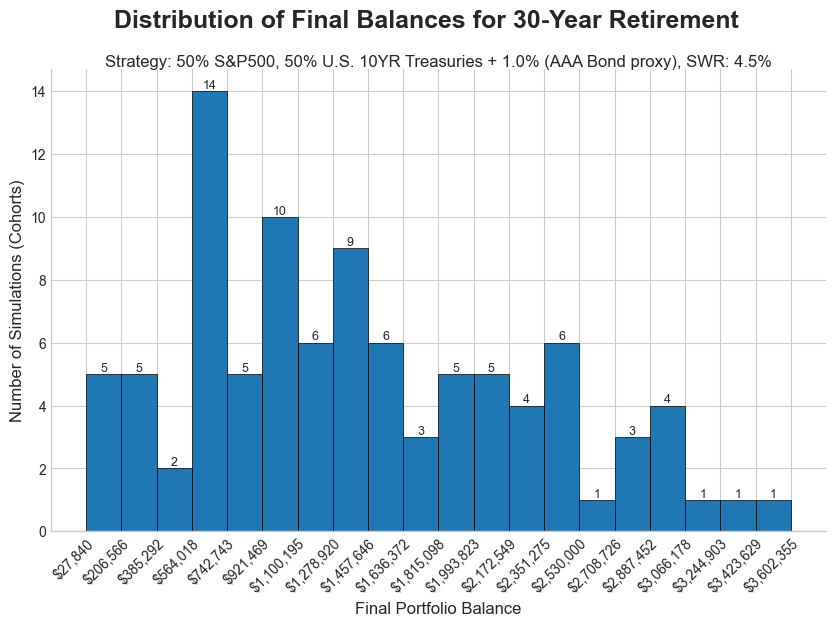

That said, lets look at similar simulation: starting balance $1M, 4.5% SWR, portfolio of 50% stocks and 50% investment grade corporate bonds, where corporate bonds are proxied by the yield on 10YR U.S. Treasuries + 1.0%. (Reference: Aaa Corporate Bond Yield Relative to Yield on 10-Year Treasury) (This points out a complexity with historical data; just getting reliable data on bond rates, for a given rating, for the last 100 years is difficult.)

Similar to the simulated results, there were no failures; but there were two results that had a final balance of < $40K. The results at the high end were not as optimistic. There is a 21.8% you pass with > $2.172M remaining in your account; which is still not bad and certainly worth having a plan in place to handle that outcome.

Is This Success, or Failure?

There are plenty of people who would say that dying with a large balance is failure; they could’ve/should’ve lived a better life.

That is a bit of the retirement conundrum. You want to have enough money to be safe for a range of outcomes, including significant recessions, stagnation, inflation over your entire retirement. But than means that if those scenarios don’t play out, you end up with more money than planned; maybe A LOT more.

What To Do?

Here are two options:

- Make plans (early in retirement) for this eventuality. Decide who (people, charities, etc.) should get what, and work with a lawyer to have a trust in place to distribute the money per your wishes when you pass.

-

Periodically, maybe every 8-10 years, check in with your financial advisor. If your withdrawal rate has dropped substantially as a percent of your portfolio due to high returns, you might decide to up your withdrawal rate.

- DO NOT increase your withdrawal rate each year your returns seem high. Part of the safety of the SWR approach is that years of high(er) returns create the buffer to withstand a downturn.

Ready to learn more?

Dive deeper into investing, saving, and withdrawal strategies through our comprehensive Learning Track.

Prefer updates in your inbox? Subscribe via Substack to get all our content delivered straight to you via email.

We love hearing from our readers. If you have questions about this post, or want to suggest a topic for a future article, please use the Chat link on our Substack home page to reach out.

Thanks for reading! This post is public so feel free to share it.

Disclaimer

**For Educational Purposes Only:** All content on this site, including articles, tools, and simulations, is for informational and educational purposes only. It should not be construed as financial, investment, legal, or tax advice. The information provided is general in nature and not tailored to any individual’s specific circumstances.

**Software Development Has Inherent Risks:** The software used to perform the analyses may have errors or inaccuracies. When we post updates to any material, errors or inaccuracies that are subsequently fixed may change the results.

**No Guarantees & Risk of Loss:** The analyses and simulations presented are based on historical data. Past performance is not an indicator or guarantee of future results. All investing involves risk, including the possible loss of principal. Market conditions are subject to change, and the future may not resemble the past.

**No Fiduciary Relationship:** Your use of this information does not create a fiduciary or professional advisory relationship. We are not acting as your financial advisor.

**Consult a Professional:** You should always conduct your own research and due diligence. Before making any financial decisions, it is essential to consult with a qualified and licensed financial professional who can assess your individual situation and objectives. We disclaim any liability for actions taken or not taken based on the content of this site.

* Nobody associated with Algorithmic Fire LLC has any credential(s) or affiliation(s) with any licensing or regulatory bodies, including but not limited to: Securities and Exchange Commission (SEC), Financial Industry Regulatory Authority (FINRA).

© 2025 Algorithmic Fire LLC. All rights reserved.